It is currently trading at $5.18 with a market capitalization of $164.2 million. The company went public in November last year at a valuation of $468.4 million. It will enable storing to multiple regions and/or multiple buckets in the same region, businesses virtually achieve an “off-site” backup-easily and automatically providing back up data access. To cater to this need, Backblaze’s Cloud Replication will help businesses apply the principles of 3-2-1 within a cloud-first or cloud-dominant infrastructure. But with the continuing growth of data needs, and the adoption of cloud technologies, this strategy is evolving as well. Traditionally, companies have followed a 3-2-1 data protection strategy, which involves three copies of data, on two types of storage media, with one copy off-site. Recently, it announced the general availability of Cloud Replication, a service that automatically stores data to different cloud locations.

#Backblaze raises subscription pricing upgrade

The program includes joint marketing efforts, collateral, and promotional funds, channel exclusive pricing, rebates, and incentives along with access to resources including staff support, automated deal registration, and lead passing.īackblaze does not provide detailed metrics on its Channel Partners or API Partners.Īdditionally, the company continues to upgrade its product offerings. The partner program is focused on supporting third party providers by helping them engage a broader group of customers with a wider variety of solutions. The Partner API allows Alliance Partners to build additional cloud services into their product portfolio, thus helping generate new revenue streams and grow existing margin.Įarlier last quarter, it also announced the launch of its Channel Partner Program. The feature will allow these partners to programmatically provision accounts, run reports, and create a bundled solution or managed service for a unified user experience. Recently, it launched the Backblaze Partner API that will enable ISVs participating in Backblaze’s Alliance Partner Program to add B2 Cloud Storage as a seamless backend extension within their own platform.

It expects to end the year with revenues of $83-$86 million and adjusted EBITDA losses of 17%-13%.īackblaze has been focused on expanding its partner program to add more value to both its community of partners and integrators.

Gross customer retention rate remained flat at 91% in the quarter.įor the third quarter, Blackblaze forecast revenues of $21.4-$21.8 million and an adjusted EBITDA loss of 18%-14%. B2 Cloud Storage NRR was 126% compared to 132% last year, and Computer Backup NRR was 107% compared to 102% in Q2 2021. Net revenue retention (NRR) rate was 113% compared to 110% a year ago.

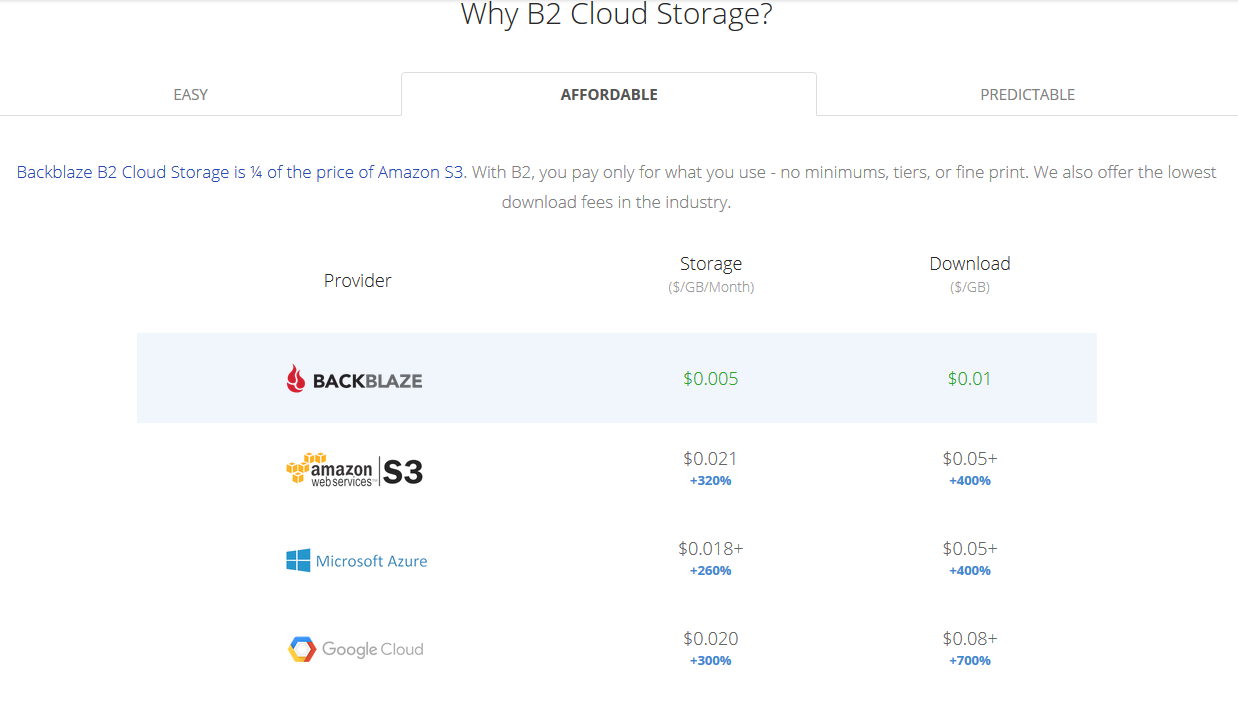

Non-GAAP net loss per share was $0.23 compared to a non-GAAP net loss of $0.19 per share a year ago.īy segment, B2 Cloud Storage revenues grew 45% to $7.7 million and Computer Backup revenues increased 20% to $12.8 million.Īmong key metrics, Annual recurring revenue (ARR) increased 28% to $82.7 million with B2 Cloud Storage’s ARR growing 44% to $31.3 million, and Computer Backup ARR growing 20% to $51.4 million. San Mateo-based Backblaze (Nasdaq: BLZE) is a rapidly growing player in the market.įor the recently reported second quarter, Blackblaze’s revenues grew 28% to $20.7 million. According to a recent market report, the global Cloud Storage Market is expected to grow at 18% CAGR from $77.5 billion in 2021 to $208.1 billion by 2028.

0 kommentar(er)

0 kommentar(er)